Families choosing not to have children are less likely to have protection cover despite being less financially engaged, according to research from Legal & General.

Its survey of 2,000 adults found UK households who had made the decision not to have children be saving money but also saw less need for protection insurance policies.

The study showed child-free families, including those with two incomes (double income, no kids, or DINKs) and just one income (single income, no kids or SINKs) were 60% less likely to take out protection insurance than a family with children.

Less protection insurance

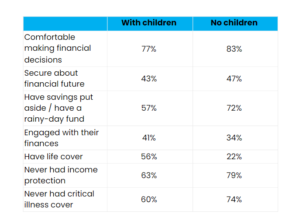

One of the largest differences between families with children and child-free families is on life cover. A total of 56% of families with children have live cover, compared to 22% for people with no children, according to Legal & General statistics.

While having children is often a trigger for making key financial decisions, child-free households continued to have products like pensions and savings accounts at the same rate as other families, but fell behind when it comes to protection insurance.

In most cases, both DINKs and SINKs said not having children was influential in their decision not to get insurance.

Many people saw products like life insurance as a way to take care of their partner and children should the worst happen. In child-free households, life insurance was less common.

Two thirds (67%) of DINKs and the majority (87%) of SINKs did not have a life insurance policy.

But childless households were also not taking out other protection products that could benefit them.

Over three quarters (76%) of DINKs and four out of five (82%) SINKs had never had income protection, and over four out of five (80%) SINKs and almost seven in 10 (67%) DINKs have never had critical illness cover.

This compared with just 63% and 60% of families with children never having had income protection or critical illness respectively.

The report also said the majority of SINKs (85%) and DINKs (63%) were financially disengaged, meaning they did not check in or engage with their finances on a regular basis – even if they were often more comfortable financially.

Legal & General said: “Child-free families are 26% more likely to be disengaged with their finances, with the majority of SINKs (85%) and DINKs (63%) not keeping track of their money, or taking actions such as reviewing budgets which could leave them better off.”

The report also found that DINKs (83%) and SINKs (81%) were more likely than other households to feel comfortable when making financial decisions, and to feel secure about their financial futures (DINKs –49%, SINKs – 39%).

Child-free families were also more likely to have savings put aside in a rainy-day fund, than families with children (DINKs -73% and SINKs -69%).

Financial engagement

Paula Llewellyn, chief customer and strategy officer, Legal & General Retail, said: “We are seeing a large number of people deciding not to have children.

“Societal pressures are lifting and young people are choosing to create their own family structures. SINKs and DINKs are feeling more financially secure and there’s a real opportunity for these groups to remain so right through to retirement.

“But there’s also a risk that the confidence that comes with having financial security, can result in poor financial engagement.

“It’s no secret that the need for protection insurance becomes more prevalent if other people depend on your income.

“But there are many benefits to products like life insurance, income protection and critical illness if you are single or do not have children.

“If you have critical illness insurance, for example, and you find yourself needing to claim due to a serious illness, your cover could pay for your living expenses if you are unable to work.

“As providers, we must understand and embrace the changing needs of families, so that we can support every type of household.“