Scottish Friendly has launched a with-profits-linked over-50s life insurance plan that could mean customers can end payments early with their full death benefit secured.

Like existing over-50s plans, the product provides a fixed cash benefit in the event of death after two years, provided customers make all their payments.

However, due to the with-profits element, after five years of payments customers will be entitled to a proportion of their selected cash benefit even if they stop paying in.

And if the mutual achieves significant investment growth on the with-profits fund this can be used to provide the customer with an early premium end date and their benefit will be paid in full on death.

Growth estimates

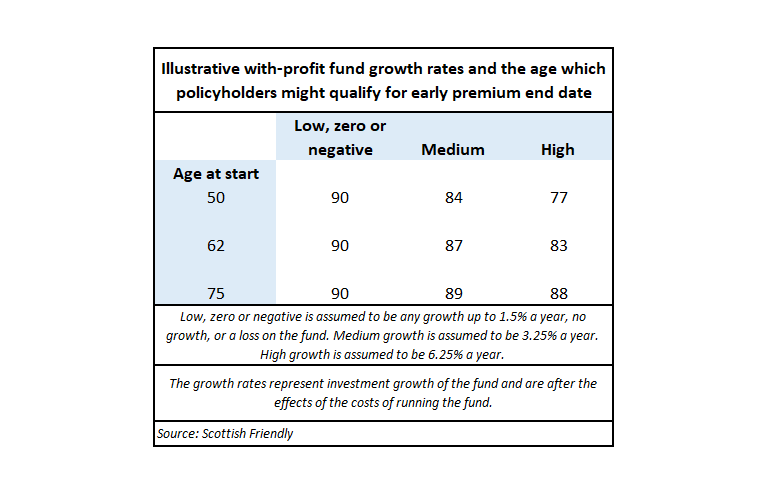

If the insurer achieves with profits growth of around 3.25% a year it estimates someone taking a policy out at 50 would be able to secure their full death benefit and end payments at 84 – saving six years from normal end age of 90. (See chart below)

For a higher growth rate of 6.25% a year this would see payments end around 13 years early at age 77.

For someone taking out a policy at age 75, the estimates to end payments are at 89 and 88-years-old for the medium and high growth scenarios respectively.

Over the last three years for which results have been published, Scottish Friendly’s main with-profits fund achieved 3.4% growth in 2020, 12% growth in 2019 and lost 3.7% in 2018.

This is in contrast to the FTSE All Share Total Return Index which lost 8.9% in 2020, gained 19.2% in 2019 and lost 9.5% in 2018.

The mutual added that it cannot guarantee the payment term of the policy will be reduced as it depends on the amount that would be paid into the policy from any growth in the fund on death.

‘Crying out for change’

The Scottish Friendly plan is available to anyone aged 50 or over, regardless of their medical history, although it must be started before the age of 75.

Customers can choose their monthly premium which starts from £7 a month and desired cash benefit.

A report from Mintel published in May 2021 found the number of over 50s life insurance policies taken out during 2020 fell 10% on the previous year, while the total value of new premiums dropped from a high of £67.1m to £61.6m.

Neil Lovatt, commercial director at Scottish Friendly, (pictured) said he believed the product will change the rules of the game going forward for over 50s plans.

“The over 50s life insurance market has been crying out for change for several years,” he said.

“We realised that we needed to come up with some radical thinking in order to improve the broken model which can expose vulnerable customers to the risk of non-payment.

“In time, as the mills of the industry grind out new product designs, we’re expecting others in the industry to follow our lead, but imitation is the sincerest form of flattery,” he added.