[SPONSORED CONTENT]

Protection advisers should use clear, simple language with young adults and understand these may be their first conversations of this kind, according to the Health & Protection panel in association with Scottish Widows.

In the second of a series of debates, the panel also emphasised the importance of involving parents in these conversations to address any questions they have.

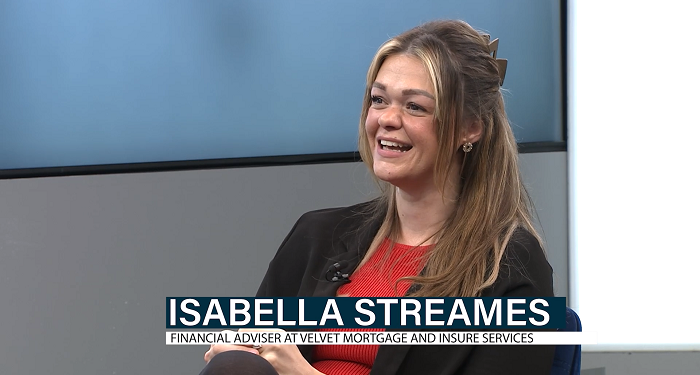

Isabella Streames, financial adviser at Velvet Mortgage and Insurer Services, explained that often young adults were having their first engagement with protection insurance when buying their first home.

As a result, she advocates using very simple, clear language and “completely stripping it back as if they are aliens and don’t understand the language I’m talking”.

“I try to make it as simple as I possibly can because the minute the consumer suddenly feels like they don’t understand they are going to shut off – it doesn’t matter what age they are if they are young or a bit older,” Streames said.

“So keep it really simple for them, make it easy to understand, maybe double checking-in as you go along the conversation that they are still with you, that they are still understanding.

“A lot of the time especially when they are younger they’ve never had conversations like that before so it’s just to make sure you’re stripping it back, going really slow and steady and just making sure that they are engaging in the conversation as well.”

And Streames added that involving parents in conversations can help to assist the process and conversation, answering any questions they may have along the way.

Julie Thompson, propositions manager at Scottish Widows, agreed it was important to build a rapport with younger adults when talking about income protection and addressing their life goals.

“That’s for all elements of life as well, not just insurance,” she said.

“Surely that’s how you relate and how you can have those authentic conversations with clients and customers, particularly with younger people who potentially could be a little more cynical.

“So building that trust with them is really more important and bringing it to life.”

Matt Chapman, the protection coach, added that it was vital for advisers to prioritise aspirational language with younger adults and their life goals, not focus on the risk of getting ill.

The Health & Protection IP Panel discussions in association with Scottish Widows can be found here.