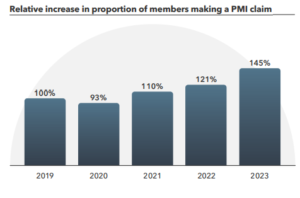

Vitality saw a 45% increase in the proportion of members claiming between 2019 and 2023 according to its 2024 Health Claims Report released today.

Vitality said: “This increase in claims has significantly exceeded the dip in activity seen due to lockdowns in 2020, indicating that this trend is here to stay.”

A significant driver of the increase has been higher demand for Vitality GP services.

From 2019 to 2023, Vitality saw a sixfold increase in virtual GP consultations, and said it had delivered 95% of consultations within 48 hours.

Vitality said: “With private GPs access ranking as the top feature customers would like to see within their health insurance, according to our recent survey, it has become an integral part of any comprehensive health insurance product.”

Vitality commissioned independent research on 1,000 UK health insurance customers for the report, to understand their attitudes towards health insurance.

In other findings the report also showed a 179% increase in member use of talking therapies since 2019.

The insurer also found that 42% of people want health insurance that supports them to be healthier and live longer, and 60% wanted a policy that makes it quick and easy to access care.

The insurer said: “Vitality’s report demonstrates that while in the past people may have purchased policies to cover the costs of private hospital treatment for elective procedures, or severe health events, the emergence of primary everyday care services, such as virtual GPs, talking therapies and physiotherapy, has revolutionised the way people use their insurance. “

The Health Claims report also showed that everyday care claims have quadrupled since 2019, making up two-thirds (64%) of all Vitality health insurance claims last year.

Other findings included a reduction in healthcare costs, where ‘highly engaged’ Vitality platinum members had 28% lower healthcare costs.

And the report also showed that highly active Vitality members live 4.8 years longer.

Vitality said there had also been a growing shift to online claims with 64% of Vitality health claims started online.

And Vitality said its members received £82 million through rewards and partners.

Keith Klintworth, (pictured) managing director at VitalityHealth said: “The healthcare landscape has transformed over the past five years.

“Gone are the days when it was enough for health insurance to merely cover the costs of hospital treatment.

“Today, customers look for a far broader range of services, from support for leading a healthy lifestyle to seamless pathways into care when they need it.

“Our members are today claiming for everyday healthcare services more than any other form of treatment, presenting an opportunity to deliver more immediate value, and intervene earlier to improve their long-term health.”