Life insurers will target technology development to increase customer loyalty and engage customers while giving advisers real time data on clients to provide a better service, according to Capgemini.

The IT services and consulting company also predicted that insurers will develop digital platforms and digitally empower agents to attract young, tech-savvy customers seeking a convenient life insurance and purchase path.

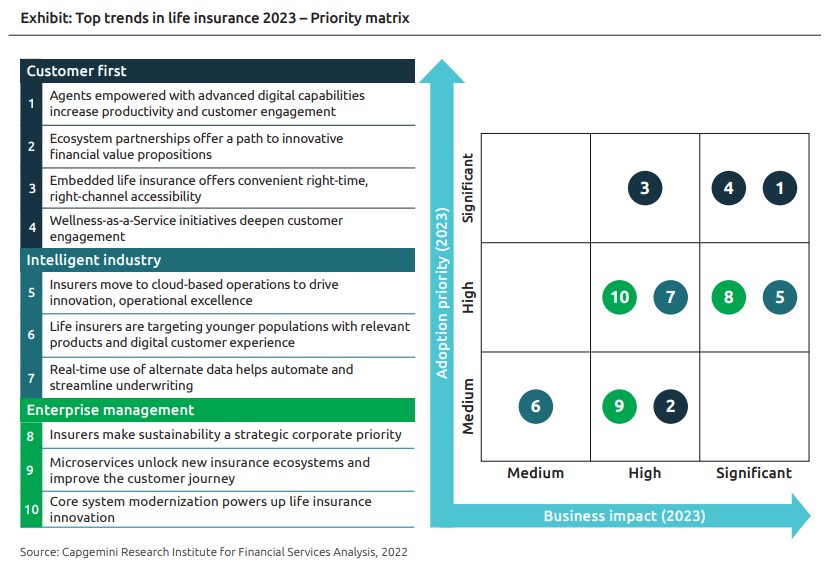

Detailing its top trends for life insurance, Capgemini revealed most life insurers will focus on compelling customer experience (CX) and interactive engagement strategies to create deeper connections, brand loyalty and retention.

It added insurer digital offerings with fewer purchase steps will lead to faster underwriting approval and policy issuance, while a shorter application process and no medical exam, which previously took up to several weeks, will also significantly improve customer experience.

With easier to buy, innovative insurance solutions, carriers can expand to include financial protection that fits millennials’ needs as they progress through various life stages, the report concludes.

Real-time data for advisers

But the report also predicts that in 2023 and ahead insurers will offer advisers more access to real-time customer data and tools that boost CX and increase policyholder retention.

This will mean adviser interactions through remote digital channels will offer an effective human connection long after the pandemic that will deepen customer relationships and increase customer lifetime value, it adds.

Capgemini argues this trend will provide material benefits for insurers, with the report pointing out that with advanced analytics tools capturing sales and engagement activities by advisers, insurers can devise strategies and support required to increase sales effectiveness.

In turn, this will improve digital distribution, increase agents’ sales performance, and lead to higher revenues for insurers.

According to the report, the next year will also see insurers make strategic investments in product innovation, API capabilities, and insurtech relationships to capitalise effectively on embedded insurance and bridge the coverage gap.

It adds new partnership opportunities will be created, enhancing value propositions and building new revenue streams for insurers and their ecosystem partners.

These investments will also help insurance firms lower distribution costs and acquire new customer data, while at the same time boosting product innovation and reducing underwriting risks.

More than just claim payers

Finally, the report also predicts that as insurers transcend the claim payer’s role in 2023 and beyond to become risk preventers, wellness providers, and partners for healthier living, customer engagement and loyalty will increase.

Engaging with ecosystem partners like wellness providers, hospitals, banks, pharmacies and retailers will enable wellness solutions to scale faster, helping life insurers capitalise on B2B2C opportunities by expanding the range of services offered, the report adds.

It points out a wellness-as-a-service framework can enable insurers to advance from a focus on transactions to one that “builds relationships via hyper personalised experiences”.

This improved experience will be enabled by superior customer journeys, innovative wellness initiatives, and connected ecosystem solutions, it adds.

And as personalised services boost policyholders’ physical fitness and general health, insurers will boost retention, reduce claims and increase the accuracy of risk assessment and pricing.

Consequently, the report concludes the most strategic life insurers will invest in advanced predictive technologies, ecosystem partnerships, and new data sources to promote healthy behaviours.