Compliance & Regulation

FCA cuts authorisations backlog by 40%

The Financial Conduct Authority (FCA) claims it has cut its authorisations backlog by 40% over the last year and is trialling automated application forms. Following reports of long delays for firms and...

Read moreFCA publishes Consumer Duty implementation timeline

The Financial Conduct Authority (FCA) has published a timeline illustrating the dates for when firms should have implemented key elements of its incoming Consumer Duty. The regulator published the final rules for...

Read moreMorganAsh updates adviser tool for Consumer Duty vulnerability requirements

MorganAsh has updated its adviser tool help businesses better manage and evaluate consumer vulnerability. As businesses prepare for the Financial Conduct Authority's (FCA) Consumer Duty, the firm has updated its MorganAsh Resilience...

Read moreFCA to review boundary between advice and guidance

The Financial Conduct Authority (FCA) is reviewing the boundary between regulated financial advice and guidance across the sector. FCA executive director for markets Sarah Pritchard announced the move which could have a...

Read moreConflict of interest and patient consent guidance tightened for private healthcare

Private medical practitioners and healthcare providers must have greater transparency around conflict of interest declarations and give more prominence to expectations around patient consent. The tighter guidelines are part of the Independent...

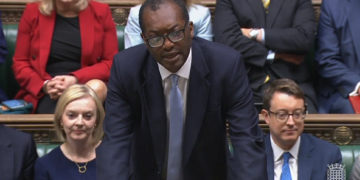

Read moreMini Budget: Tories plan ‘ambitious deregulatory package’ for financial services to drive economy

Government intends to deliver an "ambitious" deregulatory package later this autumn to "unleash the potential" of the UK financial services sector as part of its plan to drive growth across the UK...

Read moreMini Budget: Health and social care levy axing to hit exchequer by £65bn

The government's reversal of its National Insurance Contributions (NICs) hike to fund the health and social care levy will hit the UK's coffers to the tune of more than £65bn over the...

Read moreIP and PMI complaints drop – FOS

Complaints about income protection (IP) insurance dropped by 15% in the first quarter of the 2022-23 financial year, according to data from the Financial Ombudsman Service (FOS). The latest data showed 171...

Read moreABI updates minimum CI standards for dementia, cancer and heart attack

The Association of British Insurers (ABI) has updated its minimum standards for critical illness (CI) policies that must be adopted by all insurers offering these products. Changes have been made to how...

Read moreFinancial services sector needs to come together to fight financial crime amid cost of living crisis – FCA

The financial services sector needs to come together to fight the scourge of finanical crime which the Financial Conduct Authority expects to become even more prevalent amid a cost of living crisis....

Read more